How CDFA Professionals Help

By IDFA

The financial ramifications of a divorce can be devastating. But, with proper planning and expert help from professionals specializing in financially equitable divorce settlements, you can increase your chances of arriving at a settlement that fully addresses your long-term financial needs—and that of your spouse. What's missing in most settlement negotiations is financial expertise. A Certified Divorce Financial Analysts® (CDFA) professional can forecast the short- and long-term effects of various settlement proposals. By using a CDFA® professional, both partners have a clearer view of their financial future. Only then can they approach a settlement that fully addresses the financial needs and capabilities of both parties. To learn more about how a CDFA professional can help you plan your financial future, read the sample case study below.

Sample Case Study: Bob and Cindy Jones

Cindy and Bob have been married for 6 years. Cindy is 32 and Bob is 33. They have two children: the oldest 5 and the youngest is 1. Bob earns $80,000 per year and Cindy will earn $36,000 per year once she finishes her degree in three years. The children's primary residence will be with Cindy. Based on Bob's income of $80,000 per year, he will pay child support for the two children in the amount of $1,245 per month, which will be reduced to $774 per month once the oldest child reaches the age of majority. Cindy's expenses for her and the two children if she remains in the matrimonial home are $4,995 per month, which includes her tuition expenses.

Bob and Cindy own a home with $90,000 of equity. The balance of the mortgage is $130,000. They also own a rental property with $33,700 in equity and the balance of the mortgage is $100,000. Bob owns a small business with a tax-adjusted value of $201,000. The tax-adjusted value of Cindy's RRSP is $14,450. They also have credit card debt totaling $22,600.

The following settlement has been suggested by Bob and his lawyer. Cindy and the children will continue to live in the matrimonial home. Title to the home will be transferred to Cindy. The rental property will be sold and Cindy will keep the net sale proceeds. She will also keep her RRSP and the credit card debt, which she will pay down monthly. Bob will keep only his business and pay spousal support to Cindy in the amount of $2,000 per month for the first year, and $1,500 per month for two additional years while Cindy finishes her degree. To be able to pay the balance of the equalization payment owing to Cindy in the amount of $44,725, Bob will secure a line of credit and pay down the balance monthly. This appears to be a reasonably fair settlement.

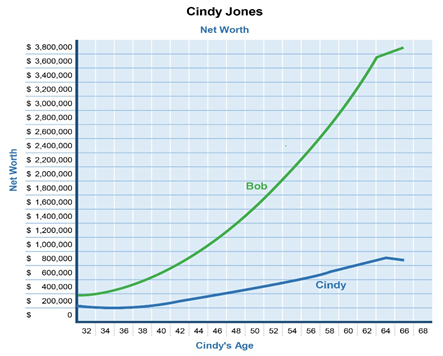

Below is a graphical illustration based on the analysis of the projected long-term financial future of both parties based on Bob's proposed settlement. Bob is represented by the green line and Cindy is represented by the blue line. First we will look at the projected net worth:

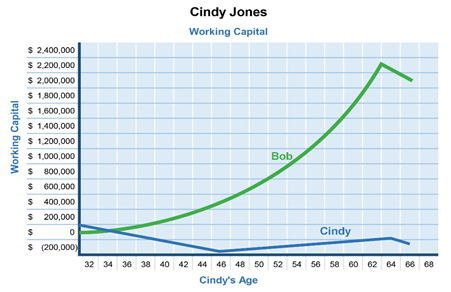

Although Bob is doing much better than Cindy, her future doesn't look too bad. Let's take a look at her working capital to see whether or not her situation is really as positive as it appears.

As you can see above, her situation is a bit worse than what is shown on the net worth statement. Cindy starts out with a negative cash flow of $19,504 in the first year because her expenses exceed her income. Cindy starts out with working capital of $76,425, but by the third year, is down to $2,485 to cover her expenses. Once the working capital is depleted, Cindy will need to begin withdrawing from her retirement accounts which are then depleted by the fourth year. By age 36, Cindy's spendable assets have been depleted.

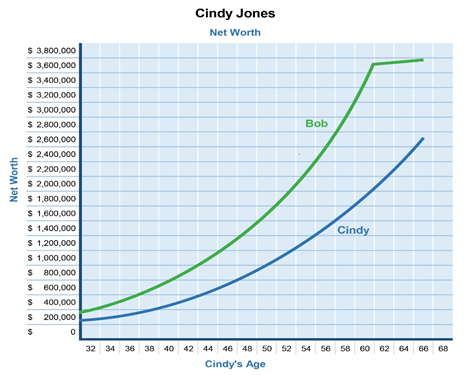

Now let's take a look at the revisions to the settlement proposal made by Cindy and her lawyer with the assistance of a CDFA professional. The matrimonial home will be sold and Cindy will keep the sale proceeds. Cindy and the two children will move to the rental property, and she will also keep her RRSP. Bob will pay $2,000 per month in spousal support for three years, indexed annually. Bob will keep his business and the credit card debt, which he will pay down monthly. Because Cindy will be living in the rental property, her living expenses are reduced. In addition, the sale of the matrimonial home frees up more working capital than if the rental property were sold. Further, by Bob assuming the credit card debt, the equalization payment owing to Cindy is reduced. Cindy and her divorce team propose that the equalization payment owing be paid to her in annual installments, thereby negating the need for Bob to secure a line of credit and pay additional interest.

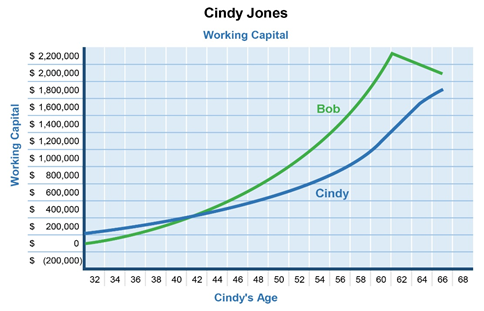

You can see from the graph above that a few changes in the distribution of assets can create a much more equitable financial future for both parties. Bob's net worth has not been affected, but Cindy's has increased significantly. Now let's look at the working capital.

Again, you can see that Bob's working capital has not changed much from the initial proposal, but that Cindy's has increased significantly. By Cindy selling the matrimonial home and moving to the rental property, she has decreased her expenses to $30,050 per year and has reduced her mortgage payments. In addition, there is an increase in working capital from the increase in spousal support and the sale proceeds from the matrimonial home. Further, because Cindy does not have to withdraw from her retirement accounts to cover the costs of her expenses, this allows them to grow to more than $230,000 by the time that she retires, thereby creating financial independence for both parties into the future.

This sample case illustrates the value of financial planning as a means of reaching more equitable divorce settlements. If the court's intent is to treat both parties in a divorce as equitably as possible, it is essential to analyze the marriage as if it were a financial contract, with tangible investment into the partnership by both parties.